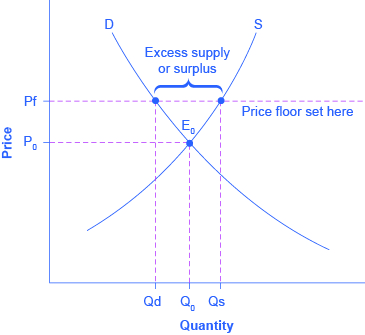

The government is inflating the price of the good for which they ve set a binding price floor which will cause at least some consumers to avoid paying that price.

A binding price floor means that.

A price floor is an established lower boundary on the price of a commodity in the market.

This has the effect of binding that good s market.

It s generally applied to consumer staples.

Such conditions can occur during periods of high inflation in the event of an investment bubble or in the event of monopoly.

Types of price floors.

A binding price floor is a required price that is set above the equilibrium price.

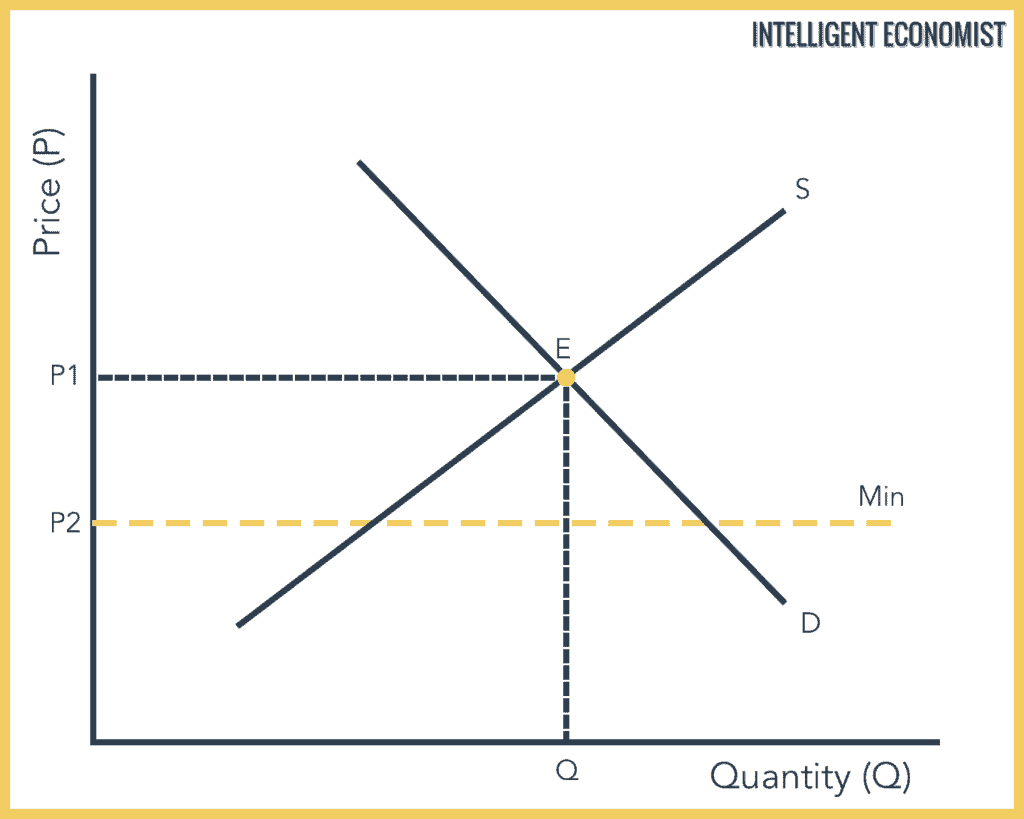

A price ceiling is a government or group imposed price control or limit on how high a price is charged for a product commodity or service governments use price ceilings to protect consumers from conditions that could make commodities prohibitively expensive.

A price ceiling is a maximum amount mandated by law that a seller can charge for a product or service.

A price floor is the other common government policy to manipulate supply and demand opposite from a price ceiling.

A minimum wage law is the most common and easily recognizable example of a price floor.

Governments usually set up a price floor in order to ensure that the market price of a commodity does not fall below a level that would threaten the financial existence of producers of the commodity.

The same concept holds with prices and a price ceiling.

A price floor means that the price of a good or service cannot go lower than the regulated floor.

Price ceilings are common government tools used in regulating.

A price ceiling means that the price of a good or service cannot go higher than the regulated ceiling.

Imagine a balloon floating in your house the balloon cannot go higher than the ceiling.

Graphical representation of tax on buyers and tax on sellers.

Floors in wages.

The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external.

If the price floor is under the equilibrium price economic effects of rent control and minimum wage short run long run per unit tax on buyers sellers and market outcome.